Harbor Core Plus Fund Strategy Profile

August 21, 2024Table of Contents

Average Annual Returns as of 06/30/2024

| 3 Months | YTD | 1 Yr. | 3 Yr. | 5 Yr. | 10 Yr. | Since Inception | Inception Date | |

| Harbor Core Plus Fund (Instl) | 0.36% | 0.14% | 3.70% | -2.48% | 0.48% | 1.78% | 6.00% | 12/29/1987 |

| Bloomberg US Aggregate Bond Index | 0.07% | -0.71% | 2.63% | -3.02% | -0.23% | 1.35% | 5.34% | 12/29/1987 |

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050. For most current performance please click here.

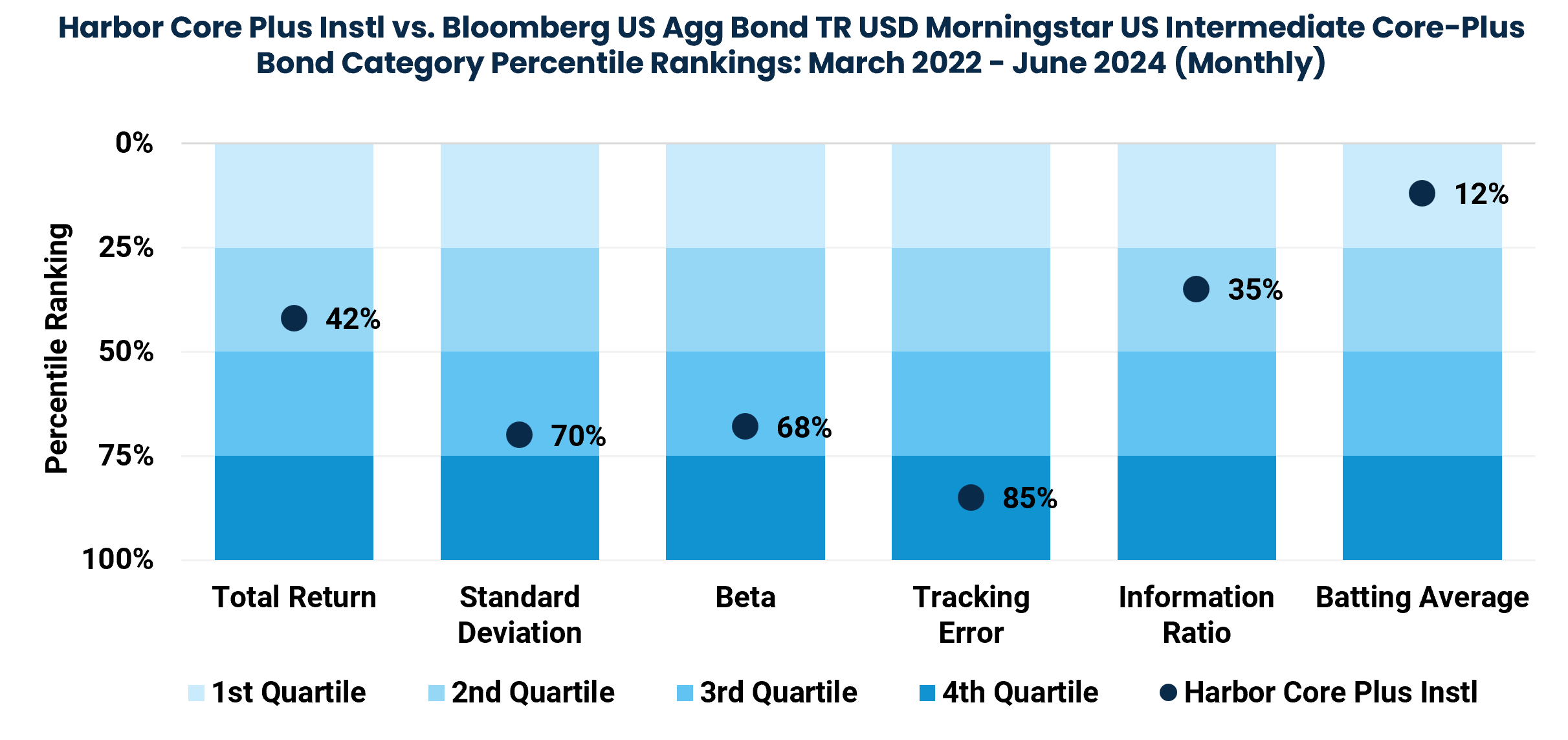

- Since taking over management of Harbor Core Plus Fund in Feb 2022 (first full month, March 2022), the Fund ranked in the 42nd percentile among peers in the Morningstar US Intermediate Core-Plus Category for total return performance.

- In addition, from a benchmark-relative perspective, Harbor Core Plus Fund exhibited 85th percentile tracking error. This placed its risk-adjusted return (information ratio) near the category’s top third with a 35th percentile ranking.

Source: Morningstar Direct. Performance data shown represents past performance and is no guarantee of future results. As of 06/30/2024 out of 593 funds. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. Fund performance used within the rankings, reflects any certain fee waivers, without which, returns and Morningstar rankings would have been lower. The Standardized Deviation, Beta, Tracking Error, Information Ratio, and Batting Average figures presented are compared against all active funds in the Morningstar Intermediate Core-Plus Bond Category whose primary prospectus benchmark is the Bloomberg US Aggregate Bond Index (527 Funds). Please see Important Information section for full period of Fund rankings.

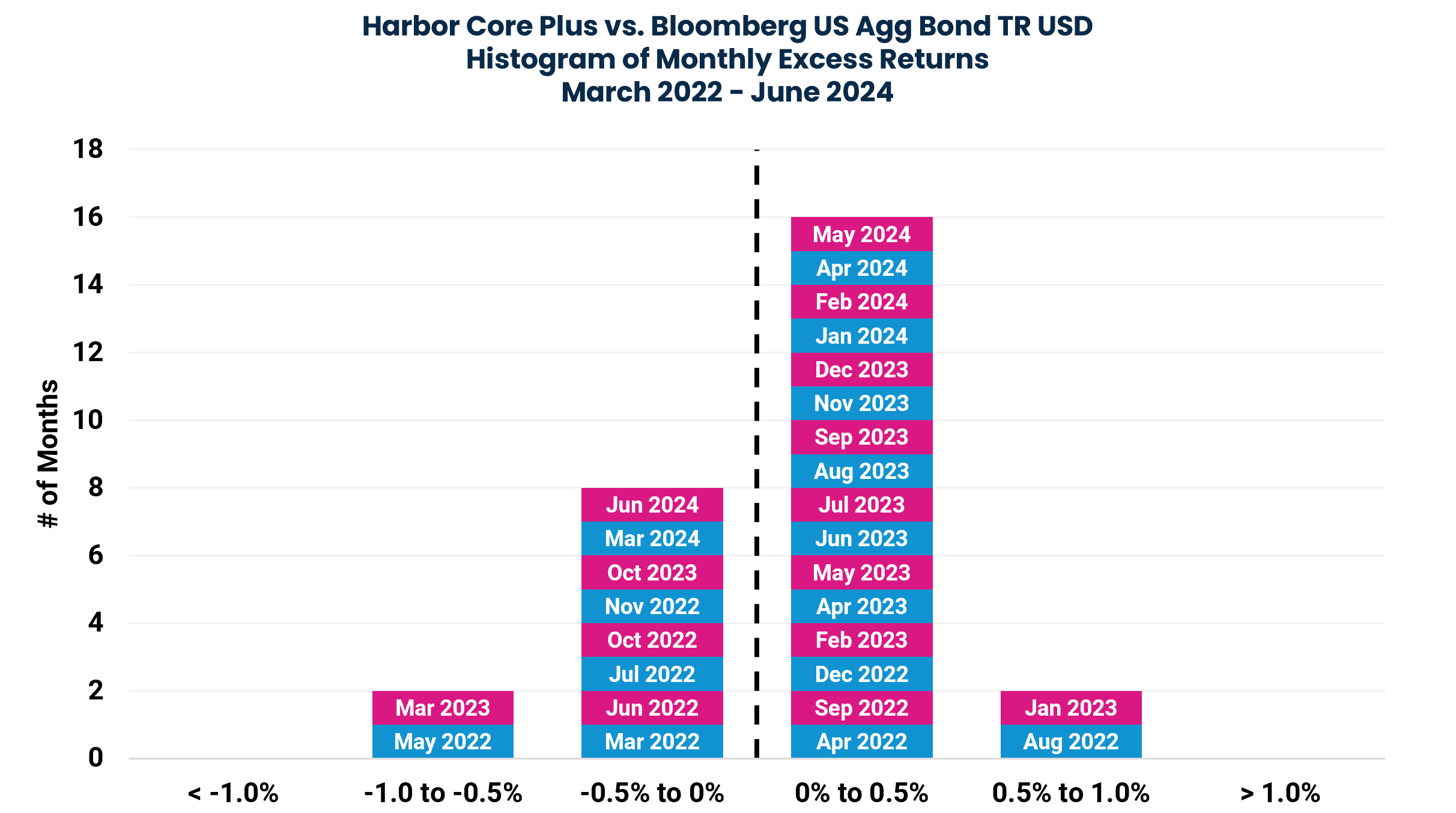

- Importantly, the Fund’s disciplined approach has led to consistency of monthly outperformance versus the Bloomberg US Aggregate Bond Index. As shown in the chart below, the Harbor Core Plus Fund outperformed its benchmark in 18 of 28 months (64% batting average) since taking over the Fund in Feb 2022.

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050. Source: Morningstar Direct.

- Founded in 1987, Income Research + Management (IR+M) is an independent, privately owned boutique investment firm based in Boston, MA.

- Ownership is widely dispersed at the firm across 73 employee shareholders*, including the majority of the firm’s investment team.

- As of 6/30/2024, the firm has $102B in AUM, exclusively across US dollar-denominated fixed income. Unlike many competing fixed income organizations, IR+M utilizes no derivatives, foreign currency or leverage across its strategies.

- The firm’s Core Plus strategy incepted in July 2017 and represents an expanded toolkit of the firm’s flagship Aggregate strategy which incepted more than 30 years ago in Dec 1991. Core Plus Assets as of 6/30/2024 are $1.51B.

- IR+M utilizes a team-oriented, bottom-up investment approach utilizing sector-specialized research analysts, portfolio managers and traders. Portfolio managers have an average 13-year tenure at the firm.

- Whereas many firms silo research, portfolio management and trading, IR+M employs a collaborative approach to these important functions. They believe this is particularly important within fixed income as individual issuers may have hundreds of bonds outstanding, making collaboration across the investment team to populate portfolios with the best raw material available paramount to success.

William O' Malley, CFA

CEO, Co-CIO

36 years experience*

James Gubitosi, CFA

Co-CIO

20 years experience*

Bill O'Neill, CFA

Principal, Senior PM

24 years experience*

Jake Remley, CFA

Principal, Senior PM

23 years experience*

.png)

Matt Walker, CFA

Senior PM

21 years experience*

.png)

Rachel Campbell

PM, Director of Securitized Research

18 years experience*

*As of 06/30/2024

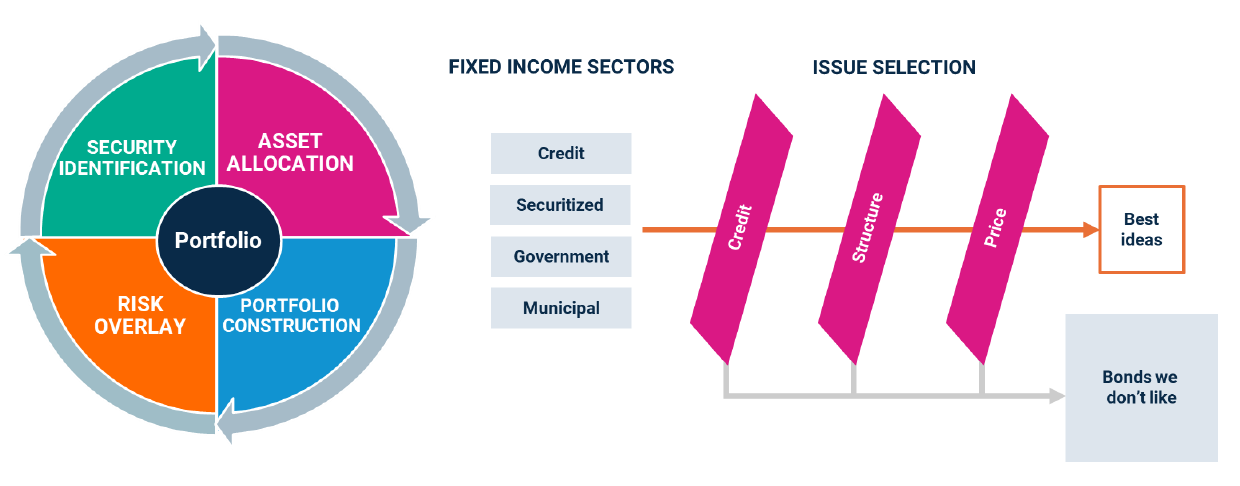

- IR+M’s investment process is driven by bottom-up security selection, with sector allocations driven through relative value and risk/liquidity assessments by the firm’s investment committee

- The firm employs a duration and key-rate neutral approach to investing (+/- 0.5 yrs of the benchmark), believing that this leads to more consistent results over time relative to potentially more volatile macro decisions. IR+M believes that very few professionals, if any, can consistently and accurately predict the direction and magnitude of interest rate changes

- Individual issues are evaluated by sector specialized research analysts and are assessed through a disciplined framework evaluating the credit, structure and price dynamics of each bond. Given IR+M’s relatively modest size they believe that they can be highly selective and can access smaller sub-sectors that larger managers struggle to tap into

- Portfolios are managed using an active risk management overlay. IR+M aims to build a portfolio with a yield advantage over the benchmark with similar average quality. The team will provide liquidity when spreads are generous but maintains a quality bias across a full market cycle. The firm’s mantra is to “take what the market gives you…”

| Share Class | Institutional |

|---|---|

| Cusip | 411512189 |

| Fund Number | 2014 |

| Gross Expense Ratio | 0.38% |

| Inception Date | 12/29/1987 |

| Manager Name | Income Research + Management |

| Benchmark | Bloomberg US Aggregate Bond Index |

| Morningstar Category | Intermediate Core-Plus Bond |

As of 6/30/2024. For Illustrative Purposes Only.

Important Information

There is no guarantee that the investment objective of the Fund will be achieved. Fixed income investments are affected by interest rate changes and the creditworthiness of the issues held by the Fund. As interest rates rise, the values of fixed income securities held by the Fund are likely to decrease and reduce the value of the Fund's portfolio. There may be a greater risk that the Fund could lose money due to prepayment and extension risks because the Fund invests, at times, in mortgage-related and/or asset backed securities.

The Morningstar Rankings are based on total returns, with distributions reinvested and operating expenses deducted. Morningstar does not take into account sales charges and other classes may have different performance characteristics. Harbor Core Plus Instl was ranked against Morningstar’s Intermediate Core-Plus Bond category, monthly, in absolute ranks based on total returns: 311 out of 618 investments in the category for the 1-year period, 146 out of 564 investments in the category for the 3-year period, 167 out of 541 investments in the category for the 5-year period, 133 out of 453 investments in the category for the 10-year period as of 06/30/2024. Using the same category, Harbor Core Plus Instl was ranked in standard deviation ranks: 393 out of 618 investments in the category for the 1-year period, 420 out of 564 investments in the category for the 3-year period, 479 out of 541 investments in the category for the 5-year period, 389 out of 453 investments in the category for the 10-year period as of 06/30/2024. Using the same category, Harbor Core Plus Instl was ranked in beta ranks: 386 out of 618 investments in the category for the 1-year period, 405 out of 564 investments in the category for the 3-year period, 380 out of 541 investments in the category for the 5-year period, 304 out of 453 investments in the category for the 10-year period as of 06/30/2024. Using the same category, Harbor Core Plus Instl was ranked in tracking error ranks: 476 out of 618 investments in the category for the 1-year period, 502 out of 564 investments in the category for the 3-year period, 513 out of 541 investments in the category for the 5-year period, 400 out of 453 investments in the category for the 10-year period as of 06/30/2024. Using the same category, Harbor Core Plus Instl was ranked in information ratio ranks: 222 out of 618 investments in the category for the 1-year period, 94 out of 564 investments in the category for the 3-year period, 28 out of 541 investments in the category for the 5-year period, 65 out of 453 investments in the category for the 10-year period as of 06/30/2024. Using the same category, Harbor Core Plus Instl was ranked batting average ranks: 136 out of 618 investments in the category for the 1-year period, 128 out of 564 investments in the category for the 3-year period, 107 out of 541 investments in the category for the 5-year period, 81 out of 453 investments in the category for the 10-year period as of 06/30/2024. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100.

Standard deviation measures the dispersion of a dataset relative to its mean.

Beta is a measure of systematic risk, or the sensitivity of a fund to movements in the benchmark. A beta of 1 implies that the expected movement of a fund's return would match that of the benchmark used to measure beta.

Tracking Error is the standard deviation of a portfolio’s relative return (relative to some benchmark). It measures the volatility of the return differences between the portfolio and the benchmark over time.

The Information Ratio (Info Ratio) of a manager series vs. a benchmark series is the quotient of the annualized excess return and the annualized standard deviation of excess return.

The Batting Average of the manager is the ratio between the number of periods where the manager outperforms a benchmark and the total number of periods.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to purchase a particular security.

Income Research + Management is a third-party subadvisor to the Harbor Core Plus Fund.

3808841