How to Invest in a More Difficult Economic Environment

September 14, 2023

According to Harbor’s subadvisor C WorldWide, a good investment requires a global perspective. Given the ongoing possibility of a recession both in the U.S. and in other areas around the world, C WorldWide further explored its belief that high-quality companies typically perform well when global economic growth slows. After all, recessions eventually come to an end, often positioning those who took a longer-term perspective well.

2023 Thus Far

From the outset, 2023 has been a challenging year with many crosscurrents. The future is difficult to predict; however, a mix of headwinds could tip both the U.S. and the broader global economy into recession. The uncertainty stems from the following:

- The impact of runaway inflation

- Interest rates going up more than expected

- Russia’s war in Ukraine

The message in early spring 2023 after the interest rate meetings at the Federal Reserve Bank and the European Central Bank is that the central banks’ top priority is still to fight inflation. And the weapon of choice is higher interest rates. So, how can investors navigate this period of macroeconomic, geopolitical, and monetary turbulence together with a slowing economy? And what about afterwards?

“Our philosophy when exploring investment opportunities is to identify companies that have the potential to consistently grow earnings over many years.”

Quality Has the Potential to Perform

Our philosophy when exploring investment opportunities is to identify companies that have the potential to consistently grow earnings over many years. We believe that earnings growth is the key long-term driver of share prices. We invest in selected companies with what we believe are long-term sustainable business models – companies that grow bigger over time. We call it the value of compounding– like a snowball growing bigger as it rolls down the hill. We think time works in favor of higher-quality earnings compounders; the opposite can be true for lower-quality companies.

In a scenario with weaker global economic growth as well as rising recessionary risks, we believe the right focus is to search for such quality companies. We think staying consistent and focusing on the long term is important. Our experience and history have shown that quality companies in many scenarios have the potential to grow earnings – even in a slow growth environment.

How To Identify Quality

Stated simply, we think quality shares are companies with:

- A stable business model – strong management teams with a disciplined focus on corporate governance

- Low debt

- High profitability

- Low-profit volatility

- High return on equity

At the same time, quality companies often have pricing power. Pricing power is particularly relevant in inflationary periods because it becomes an advantage to pass on the cost for more expensive raw materials to the customer.

To Minimize the Risk

Some investors might say that focusing on quality companies and taking a long-term view is too defensive or even a dull approach. Stability is simply not exciting enough. Many find it more appealing to chase short-term profits, follow the herd and market momentum trends or even go for a little excitement offered by the latest “high fashion” stocks which we believe, more often than not, are based on adventurous storytelling rather than the reality of real growth fundamentals. In other words, why not go for the rockets with more explosive characteristics as opposed to playing the long game? The answer is: to minimize the risk. We believe that patience is a virtue – and this is no different regarding successful investing.

In our view, using a traditional risk/reward framework remains the best approach and avoiding extreme scenarios is key to prevent permanent loss of capital. Successful investors often balance investment returns with investment risk. Searching for quality can mean concentrating on real fundamentals and on the proven ability to earn money today and in the years to come. As we usually say, successful investing is not a sprint – it’s a marathon.

“We invest in selected companies with what we believe are long-term sustainable business models – companies that grow bigger over time. We call it the value of compounding.”

Green Dreams and Red Alerts

Of course, it’s both thrilling and tempting to ride on the wings of possible current “winners” which is proving popular right now among certain investors. The “green transition” trend is a good example. In previous years, many newer companies appeared on the market with products or services addressing this popular trend. Some flew into the sky like rockets on the stock exchanges. And many fell to the ground again.

The reasons are fairly simple: it is often difficult for many of the companies that are targeting the green transition to prove their ability to earn money and grow sustainably for a long period of time. This is often because of their uncertain business models, highly competitive landscapes, and a market highly influenced by government policies and regulations.

“As we usually say, successful investing is not a sprint – it’s a marathon.”

Many start-ups need to raise a lot of money with no proven track record of their ability to grow and provide positive returns. Even well-known companies operating in the green transition space with many years in the market have experienced problems with cash flow and profitability.

Having said that, the green transition is necessary. Wind turbines, solar cell systems, Power-to-X, hydrogen technology and any kind of alternative energy development to fight climate change will be a huge trend for the next decade. Enormous investments are truly needed. But where to invest is not an easy task.

Quality – An Attractive Option to Navigate Through Recessions

As the world moves towards slow growth or a recession, we believe that long-term interest rates will stabilize and eventually fall as inflation moderates. Also, global debt levels in the world are so high that the world can not afford high interest rates over the long term.

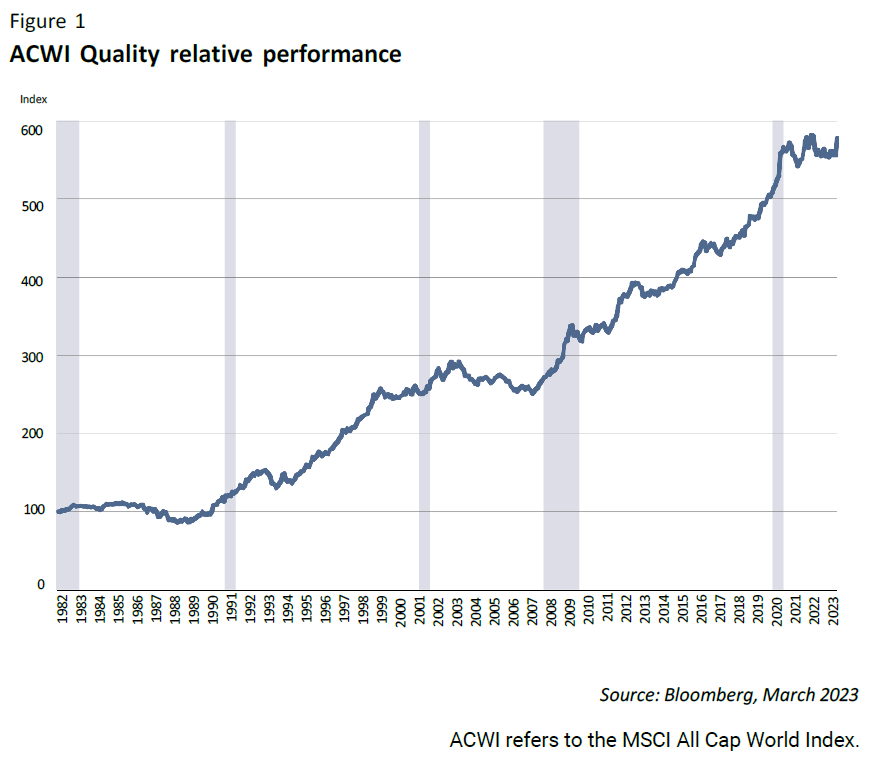

The history of past recessions shows that quality companies typically outperform. The grey areas on the figure show periods when the economy is in a recession, and as can be seen in Figure 1, quality has outperformed during those periods.

The graph above also shows that quality companies struggled during 2022 due to the drag of rising interest rates hurting the relative valuation of quality companies as these are typically long-duration assets. Rising interest rates can hit companies with sustainable long-term earnings growth as the discounted value of future earnings decreases. But as mentioned, we don’t expect that long-term rates will increase markedly from current levels, thereby gradually removing the valuation drag and enabling individual company performance to regain center-stage.

Our philosophy and approach to investing continues to be that time in the market is more important than timing the market. Therefore, identify quality companies, and be patient over the longer term.

Important Information

The views expressed herein are those of C WorldWide at the time the comments were made. These views are subject to change at any time based upon market or other conditions, and the author/s disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions.

Indices listed are unmanaged, and unless otherwise noted, do not reflect fees and expenses and are not available for direct investment.

The MSCI All Country World Index (ACWI) is a stock index designed to track broad global equity-market performance. Maintained by Morgan Stanley Capital International (MSCI), the index comprises the stocks of nearly 3,000 companies from 23 developed countries and 25 emerging markets.

3112259